Pope Francis has it exactly backwards. Again.

March 16th, 2014

Pope Francis is quoted in the March 8 2014 Economist:

“While the earnings of a minority are growing exponentially, so too is the gap separating the majority from the prosperity enjoyed by the happy few,” he has written. “This imbalance is the result of ideologies which defend the absolute autonomy of the marketplace and financial speculation. Consequently, they reject the right of states, charged with vigilance for the common good, to exercise any form of control.”

No, “the absolute autonomy of the marketplace and financial speculation” is precisely what we don’t have. As an old-time socialist friend once said, “The main problem with capitalism is that we don’t have it.”

His Holiness has it exactly backwards, and in two independent ways at that.

First, “the earnings of a minority growing exponentially” is not a problem unless it comes at the expense of others. Reminds me of “Tax the rich, feed the poor/ till there are no rich no more”; it is poverty that we want to eliminate, not wealth.

Second, and less obviously, the reason crony capitalists have enormous fortunes is precisely because politicians do have the power “for the common good, to exercise any form of control”.

As long as politicians have power, whether “for the common good” or with any other excuse, to pick winners and restrict competition, people will find ways to corrupt politicians to get these goodies.

Whatever the original motivation, regulators are always and everywhere captured by the regulated, who write regulations for their own benefit.

Capitalism works for the public good only when people are allowed to freely trade with one another without permission or blessing from heavily armed government thugs.

The things Pope Francis doesn’t like about capitalism are not part of capitalism. They are part of the doomed attempts to “regulate” it. His Holiness doesn’t understand what capitalism is. Neither do most capitalists. Or most Republican “defenders of capitalism“. Maybe we need a new word.

Smile economics – maybe Pope Francis is right

September 22nd, 2013

I read today that Pope Francis thinks the global economic system shouldn’t be based on “a god called money”, and that “Men and women have to be at the centre (of an economic system) as God wants, not money.”

Maybe he’s right. Our economic system should be about people – that’s who it is supposed to be for.

We should have an economic system that encourages people to help each other out, and voluntarily give one another the things they need. One that works without threats and coercion, and which makes people want to be nice and helpful to each other.

Here’s an idea I’ll call “smile economics” – it’s based on an economy of “smiles”:

Each time someone does something nice for a stranger (helps them out, gives them something they need, etc.), that person should give “smiles” in return – to show their appreciation of the nice thing. It might be a lot of “smiles”, or just a few, depending on how big the favor was.

(This would be mostly for use with strangers – people tend to be naturally nice to their friends and relatives.)

The people who accumulate lots of “smiles” would be those who are especially nice and helpful to others. Of course most people want to be perceived as nice, so wanting to have lots of “smiles” would act as a social incentive to encourage everyone to be nice to each other.

Now, when someone really wants a lot of help or something from other people, they could offer a lot of “smiles” for that help. Other people would know that they can really help someone a lot, if that person is offering a lot of “smiles” for the help. Because people want “smiles”, and everyone would know that others wouldn’t offer to give away many “smiles” unless they really wanted the help very much.

Here is the best part – even people who are not naturally nice – selfish people – would want to be nice, in order to get “smiles”.

Why? It’s true that nasty people often don’t care what people think about them. But in order to get help and other things they want from strangers, they’d need to offer “smiles”. Probably they’d have to offer even more “smiles” than nice people, because people don’t generally want to help nasty people. So, in the “smile economy”, nasty people would have to to be nice to others, in order to get the “smiles” they need to get the things they selfishly want for themselves. (Because, in this system, they can’t just buy what they want with money – they need “smiles”.)

“Smile economics” actually makes nasty people want to act nice, in order to satisfy their own selfish desires. It actually makes their own selfish interest drive them to be nice to other people! How about that!?

Of course, to do the most good, the system should be utterly universal and work between strangers of all races, religions, and nations, no matter where they are. We want to encourage people to be nice to one another no matter who they are. Anyone who said, for example, that someone in Brazil shouldn’t do nice things for someone in China (or any other pair of countries) would be seen as evil – because wanting people not to be nice to each other is evil. Nobody should ever tell anyone not to be nice to one another.

What do you think?

Addendum – A few people who have read this think it won’t work because people can just make fake “smiles” all the the time (as many as they want) in order to get things. They have a point. So let’s say that everybody gets a certain limited number of “smiles” to spend – maybe eight or ten each day (they can save them as long as they like).

Addendum #2 – In case it still isn’t clear, it doesn’t need to be “smiles” that people give as a reward. It could be anything that’s limited in number which other people value – for example pretty marbles (if they’re hard to get), or shiny rocks, or little pieces of gold. Or what the Spanish used to call “pesos de ocho” (pieces of eight). Or Greek drachma, Pakistani rupees, or Thai baht. Japanese Yen would work. Or Bitcoins. I suppose those all have their pros and cons, but it doesn’t really matter.

You get the idea now, I’m sure. Pope Francis is going to love this idea!!

I invented many common & important technologies

April 15th, 2013

Did you know I invented many of the key technologies used to drive today’s world?

It’s true – I did. All by myself. I ran across this yesterday:

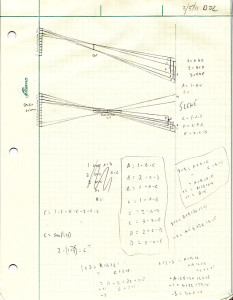

It’s a 2011 scribble from when I was inventing deconvolution.

In fact I’ve invented so many common technologies that I’ve forgotten about most of them. A few that I do remember are:

| Technology | Concept | Implementation | Notes |

|---|---|---|---|

| Dither | ~1974 | – | As a child playing with circuits. |

| FIFO queues | 1978 | 1978 | I called them “circular buffers”; never heard of terms “FIFO” or “queue”. |

| Remote Desktop[1] | ~1980 | – | I was going to do it for the TRS-80 (Models I and III) and call it “Guest/Host”. |

| Web prefetch | ~1984 | – | Well, prefetch for web-like services, anyway. Pre-fetch the results from each of the 6 or so menu options on CompuServe Information Service (CIS), to save download time on your 300 bps modem. |

| Key splitting | ~1990 | – | Split a key into N parts, of which M (M <= N) are needed to use the key. |

| Google Earth | 1990 | 1991 | I started a company to do it. We were going to use CD-ROMs, because they hold so much data. Sigh. |

| Internet-controlled thermostat | 1997 | – | From my notes: “Thermostat with Internet interface so you can remotely set and test (and read history?) via Internet (or POTS); for travelers.” |

| Superresolution | ~1999 | – | Motivated by early digicams with lenses that could resolve more detail than the sensors of the time. |

| Deconvolution | ~1999 | 2011 | For lensless imaging. Dropped it when I discovered it required far more bits of ADC than available in real sensors (or even real photons). |

| Camera orientation sensor | ~2001 | – | Gravity sensor in digital camera detects if it’s being held in landscape or portrait orientation, then sets a bit in the image to display it properly. |

Of course, I don’t claim to have been the first to invent any of these things.

The astute reader will note that all these invention dates are all long after these technologies were already well-known. That’s because I re-invented them independently (having never heard of them). The chance to do that is one of the perks of having little formal education.

I’ve often thought that more than 99% of what any individual learns during a lifetime is lost when they die – only the tiny fraction of 1% that gets written down, successfully taught, or copied, benefits anyone else. It’s a terrible waste.

And this shows that even for that tiny fraction of 1% that is written down, many people (perhaps most?) end up having to re-discover it from scratch, either because that’s easier than understanding someone else’s explanation, or because it’s too hard to find out that someone else already has solved the problem.

Makes you think a bit about the meaning of “obvious at the time the invention was made to a person having ordinary skill in the art“, doesn’t it?

[1] I did have a little bit to do with inventing RDP (the first invention, that is), but that wasn’t till the 1990s…

Perhaps it had to come to this…

December 18th, 2012

From Techdirt, 2012-12-17:

China Tries To Block Encrypted Traffic

from the collapsing-the-tunnels deptDuring the SOPA fight, at one point, we brought up the fact that increases in encryption were going to make most of the bill meaningless and ineffective in the long run, someone closely involved in trying to make SOPA a reality said that this wasn’t a problem because the next bill he was working on is one that would ban encryption. This, of course, was pure bluster and hyperbole from someone who was apparently both unfamiliar with the history of fights over encryption in the US, the value and importance of encryption for all sorts of important internet activities (hello online banking!), as well as the simple fact that “banning” encryption isn’t quite as easy as you might think. Still, for a guide on one attempt, that individual might want to take a look over at China, where VPN usage has become quite common to get around the Great Firewall. In response, it appears that some ISPs are now looking to block traffic that they believe is going through encrypted means.

A number of companies providing “virtual private network” (VPN) services to users in China say the new system is able to “learn, discover and block” the encrypted communications methods used by a number of different VPN systems.

China Unicom, one of the biggest telecoms providers in the country, is now killing connections where a VPN is detected, according to one company with a number of users in China.

This is the culmination of at least 35 years of official concern about the effects of personal computers.

I’m old enough to remember. As soon as computers became affordable to individuals in the late 1970s there was talk about “licensing” computer users. Talking Heads even wrote a song about it (Life During Wartime).

The good guys won, the bad guys lost.

Then, even before the Web, we had the Clipper chip. The EFF was created in response. And again the good guys won.

Then we had the CDA, and then CDA2. And again, the bad guys lost and the lovers of liberty won.

In the West, the war is mostly over (yet eternal vigilance remains the price of liberty).

Not so in the rest of the world, as last week’s ITU conference in Dubai demonstrated.

I say – let them try it. Let them lock down all the VPNs, shut off all the traffic they can’t parse. Let’s have the knock-down, drag-out fight between the hackers and the suits.

Stewart Brand was right. Information wants to be free. I know math. I know about steganography. I know about economics.

I know who will win.

Questions are more valuable than answers

October 24th, 2012

…at least if you’re Google.

The interesting site Terms of Service; Didn’t Read gives Google a thumbs-down because “Google can use your content for all their existing and future services”.

I don’t think a thumbs-down is really fair here – I mean, that’s the whole point of Google.

Google is a service that gives out free answers in exchange for valuable questions.

Answers are worthless to Google (though not to you) because Google already knows those answers. But it doesn’t know your questions. So the questions are valuable (to Google, not to you). Because Google learns something from every question.

When you start typing a search into Google and it suggests searches based on what other people have searched for, that’s using your private information (your search history) to help other people. They’re not giving away any of your personal information (nobody but Google knows what you searched for or when), but they are using your information.

Google gets lots of useful information from the questions that people ask it. It uses that information to offer valuable services (like search suggestions) to other people (and to you), that they make money from (mostly by selling advertising).

That’s not a bad thing. It’s the only way to do many of the amazing, useful, and free things that Google does. I’m perfectly fine with it, but you have to more-or-less trust Google to stick to their promise to keep your private info private.

I think Google does a lot more of this than most people suspect.

When you’re driving and using Google Map to navigate, you’re getting free maps and directions. But Google is getting real-time data from you about how much traffic is on that road, and how fast it’s moving.

When you search for information on flu symptoms, Google learns something about flu trends in your area.

Sometimes I ask Google a question using voice recognition and it doesn’t understand. After a couple of tries, I type in the query. I’ve just taught Google what I was saying – next time it’s much more likely to understand.

When you use GMail, Google learns about patterns of world commerce and communication, who is connected to who, who is awake at what time of day, etc. Even if it doesn’t read the contents of the mail.

When you search for a product, Google learns about demand in that market, by location and time of day and demographics (it knows a lot about you and your other interests).

Google learns from our questions – answers are the price Google pays for them.

Why school reform never works

March 4th, 2012

Annie Keegan has a posting on open.salon.com about textbook quality that has been getting a lot of attention lately. It’s worth a quick read.

She bemoans the quality of (US) K-8 math textbooks, and blames it on rushed and underfunded development schedules caused by the greed of a quasi-monopoly of “educational publishers left after rabid buyouts and mergers in the 90s”, plus squeezed budgets.

Of course this is true in a trivial sense – the textbooks are in fact horrible, publishers do try to maximize profits, budgets are always less than one would wish, and the textbooks are indeed “there’s no other way to put it—crap”[1].

But she completely misunderstands the causes. And this misunderstanding is likely to lead to more of the same problems, instead of solutions.

Keegan writes:

At one time, a writer in this industry could write a book and receive roughly 6% royalties on sales. The salesperson who sold the product, however, earned (and still does) a commission upwards of 17% on the same product. This sort of pay structure never made sense to me; without the product, there’d be nothing to sell, after all. But this disparity serves to illustrate the thinking that has been entrenched industry-wide for decades—that sales and marketing is more valuable than product.

First, the 6% royalty on all sales of the book is not comparable to the 17% commission on an individual sale to a single school. The salesperson only earns commission on what she sells. There are many salespeople who split that 17% of the book’s total sales, but only one author who collects all of the royalties.

And I don’t think Keegan would complain that a bookshop earning a 40% markup on a book is an indication that retailing is somehow more important than authorship.

Second, the “the thinking that has been entrenched industry-wide” does not decide how “valuable” each contribution to making a book is. There could never be any consensus on that.

Instead, compensation is based on supply and demand – if more people want to be textbook authors, that increases the supply and reduces the pay. If less people want to sell them, that decreases the supply and increases the value of salespeople. If Ms. Keegan thinks salespeople have a better deal, perhaps she should become one – this is how the market shifts labor (and other resources) from less-valuable to more-valuable purposes. If she prefers to remain an author despite the (supposedly) lower pay, that’s her choice, and that choice shows that, to her, being an author (with lower pay) is better than being a book salesperson (with higher pay). She ought not to complain if she is better off — by her own standards.

But none of these misunderstandings get to the heart of why the books are “crap”.

The books are not crap because of the publisher’s greed and the limited budgets.

People who make televisions and plumbing supplies and instant noodles are greedy humans, too. And the people who buy them always wish they had more money to spend than they do. Yet these things aren’t crap.

School textbooks are crap because, unlike televisions and plumbing supplies and instant noodles, the people who make the decision to buy them (administrators and school boards) are not the same people who use them (students and parents).

These two groups of people – buyers and users – have different priorities. The quality of content is foremost for the users of the textbook, but the buyers are easily influenced by other things – fun trips to “educational seminars”, fancy lunches paid by salespeople, kickbacks of varying forms and legality, etc.

In the end, publishers must supply what buyers want, or face being replaced by other publishers who will. What students and parents want is relevant only insofar as it influences what buyers want. Even if a publisher were to have high standards, ensure adequate budgets and schedules, etc. to produce a high-quality product, this would only mean that their expenses would be higher than those of publishers who concentrate only on what sells books.

This problem cannot be solved by changing how publishers work or how school boards and administrators buy textbooks. Buyers will always do what is good for buyers and sellers (publishers) will always do what is good for sellers – increasing budgets simply means they will do more of it. This is an iron law of nature.

The only solution is to make the buyers care more about the wishes of the users – parents and students. As long as students are assigned to schools without choice, administrators have little reason to fear losing students and the funding the comes with them – it’s easy to prioritize (and rationalize) their personal interests as buyers over the interests of users. School choice forces administrators to care about losing dissatisfied students and parents – and so to demand quality textbooks.

Like pushing on a string, changing what suppliers offer does not change what buyers want. Buyers will simply find other suppliers with less scruples. You can only pull on a string – change will happen only when buyers demand better quality from publishers, and that can happen only when buyers and users have the same interest – quality textbooks and quality education.

————-

[1] Of course the whole issue with math textbooks is moot because math doesn’t change; there’s no reason to update math textbooks in the first place. If you’re a school, my advice is to find a good math textbook that’s 100+ years old (and therefore out of copyright) and use it.

But book salespeople won’t take you on fun trips if you do that, so while this advice is best for your students, it might not be best for you as an administrator. Which is my larger point.

(Some will say that math doesn’t change but teaching methods do – I agree, but for the very same reasons that textbooks are “crap”, they don’t change for the better.)

Or, you could let the market work

May 18th, 2011

[Hint: You can get around The Economist‘s paywall by linking via Google – just put the URL into Google, then click on Google’s link to the article.]

Last month there was a story about various dirigiste steps the Japanese government might take to deal with the post-tsunami electricity shortage in The Economist (of all places). They published my response in the May 14 issue, again with some unfortunate editing (see “The market for electricity”, halfway down the page). Here is my original version:

Date: Sat, 07 May 2011 19:06:22 -0400

To: letters [at] economist.com

From: Dave <dave [at] mugwumpery.com>

Subject: Or, you could let the market workDear Sir:

I agree with your assessment (“A cloud with a green lining”, 30 April) that Japan’s government has many options to deal with the electricity shortage resulting from the earthquake and tsunami. As you say, they could encourage solar power, subsidize LED lighting, push for batteries to shift demand away from peaks, etc.

Alternatively, they could do nothing at all, and allow electricity users to bid up the price of power until demand drops to meet the limited supply. The resulting high price would by itself encourage alternate sources of supply and force conservation without any need for “publicity” or nagging. More, it would encourage people to find clever ways to increase supply and reduce demand that the mandarins in Tokyo might never have thought of.

And all without costing taxpayers a penny, or feeding subsidies to the politically-connected.

The sad thing here (on top of the greater tragedy of the earthquake itself) is the lost opportunity for entrepreneurs to come up with efficient and innovative solutions to address the electricity situation.

But the market works even when governments attempt to suppress it – just less efficiently. If the Japanese government decides to dole out subsidies and propaganda instead of letting the electricity price rise, that won’t end the shortage. Rolling blackouts will still cause electricity consumers to increase their own electricity supplies, and adapt their demand to the blackouts, by buying their own generators, investing in battery storage to supply power during down-times, etc. But there will be a lot less incentive to cut consumption, since cheap power will still be available in bursts.

Eventually the Japanese electric grid will be rebuilt to handle the demand, but in the meantime adaptation will be slower, and the pain more prolonged, than it would be had the authorities let the market do its thing. But despite the best efforts of the government, electricity users will adjust and find ways to get by with the limited supply. And that is the market in action.

Copying is not theft

February 24th, 2011

Another letter to the Economist:

Date: Thu, 24 Feb 2011 09:06:36 -0600

To: letters [at] economist.com

From: Dave <dave [at] mugwumpery.com>Subject: Re “Ending the open season on artists”, 19 February

Dear Sir,

As a an “aghast” digital libertarian, I object to your presumption that stronger copyright enforcement is good or necessary for artists.

No one disputes that artists must be rewarded for successful creation. (Middlemen are another story.) Copyright was a reasonably effective system when copying was expensive anyway and the means of reproduction were relatively centralized publishers and distributors, easily policed. Now that works can be copied costlessly by any individual, the principle of limiting copying is both unworkable and inappropriate, as copying (although illegal) is not theft – because copying does not deprive the original owner of anything.

Certainly, artists must eat. The challenge is to find new business and legal models to accomplish that without needlessly depriving the public of the full enjoyment of the fruits of creation.

Attempts to perpetuate obsolete business models by law are not the solution.

It is hard to make a strong argument in a letter short enough to get published.

My larger point is that there is what economists call a “deadweight loss” when someone who would have enjoyed a creative work doesn’t because of costs imposed by copyright.

Say we’re talking about a copy of The Beatles “A Hard Day’s Night” (which, completely off-topic, has some of the lamest lyrics imaginable – “…to get you money to buy you things“??).

Some consumers are willing to pay the asking price for the song under the copyright system. In that case the artists get 10 or 20%, and the middlemen get the rest. (And yes, the studio technicians, etc. need to get paid too, but not necessarily by a record company – painters seem quite able to buy blank canvas without middlemen to help.)

But more consumers (usually far more) are not willing to pay that much. They’d enjoy having a copy of the song, but not enough to justify the price. These people are going to be in the majority almost regardless of the price asked. This is the deadweight loss; value that could have been realized without cost to anyone, but wasn’t.

To make it clearer – imagine we’re talking about a $1000 copy of Adobe Photoshop instead. How many of the people who would benefit from using it are willing to pay that much? Very few. Yet it would cost Adobe nothing at all to let them use it for free – if that didn’t discourage those few who would pay from doing so.

Of course, under the copyright system this loss is necessary to make the system work – otherwise no one at all would pay. And this is precicely the problem with the copyright system – it necessitates the deadweight loss to work.

As I implied in the letter, this wasn’t such a terrible flaw when copying was expensive anyway. Records couldn’t be produced for free; paying the artist a royalty only increased the price a little bit, so not much harm was done. But that’s not true in a world where copying is free.

So we need a new system to reward creators for successful creation that other people value. I can imagine a half-dozen ways to do it; so can you. It will take some experimentation and evolution to get there, but propping up the obsolete copyright system is not going make it come sooner.

AT&T’s roaming fees and the American Way

August 23rd, 2010

Last week I came back from a brief visit to Croatia (visiting family).

I took along my trusty iPhone, having first jailbroken and unlocked it, so I wouldn’t get whacked with AT&T’s international data roaming fees.

Over the course of 10 days, I used 44 Mbytes of data; I consider that quite moderate – a little Web browsing, minimal email, and some Google Maps. (I’d expected to use about 10x as much.)

I bought a SIM card from one of the local networks, VIP (a Vodafone affiliate, I think).

VIP’s deal was as follows: For HRK 100 (US $17.40 at today’s exchange rate), you get a prepaid SIM card loaded with HRK 100 of credit. Calls come out of that at $0.14 to $0.44/minute, depending on time of day and what network you’re calling (landlines are less). International calls are $0.47 to $1.08/minute, depending on where you’re calling (calling the US is the $1.08/min rate).

Again out of your HRK 100 credit, you can buy data service – 20 MBytes for HRK 15 ($2.61) or 100 MB for HRK 30 ($5.23). (Don’t believe me? Look here. ) I went for the 100 MByte deal, using up HRK 30 of my HRK 100 credit. Since I only used 44 MBytes of that, the rest went to waste. I don’t really know how much credit was left when I came back to the US; but I know I was able use voice and data both in the Munich airport and in the USA using the same card.

So, 10 days’ use of the iPhone, voice and data, cost me $17.40. And I didn’t use it all up. (Service was great, by the way – much better 3G data coverage in rural areas than I get in the USA.)

Just for curiosity, I checked how much AT&T would have charged me for the same thing.

Their standard international data roaming rate is quoted as $0.0195/kByte. That’s just shy of 2 US cents per 1024 bytes, or $20/MByte. I used 44 MBytes so that would have been $879. Yes, nearly nine hundred dollars. For very light usage; I could easily have used many times more if I’d been traveling for business.

But, of course, AT&T says if you’re going to be travelling internationally, you really ought to buy one of their “Data Global” packages – 20 MB for $25/month, 50 MB for $60/month, and $120 for 100 MB. (Recall that I bought 100 MB from VIP for $5.23.) And if you go over your monthly allowance, it’s $10/MB.

What is AT&T thinking?

Google on “iPhone international data roaming” and you’ll find lots of horror stories about multi-thousand-dollar AT&T bills from short trips. I didn’t get whacked, but what does AT&T think is going to happen when someone gets a $3000 bill after two weeks in London, or a $60,000 bill after downloading one episode of “Prison Break”? They might or might not get paid, but for sure they are going to lose a customer – forever. Each and every time they send out a bill like that.

It may be legal, but it is bad business – incredibly bad business.

One of the things that has made the US such a wealthy country is a business culture that includes the idea of a “fair price”. Although it’s generally legal to charge any price the market will bear – even taking advantage of buyer ignorance or desperation – mainstream American culture supports the notion that there is a “fair price” – the price that an informed buyer would pay in a competitive market, considering circumstances of location, quality, convenience, etc.

So, for example, Americans frown upon selling generators for $10,000 during a blackout, if they go for $1000 at normal times. Or the rural tow truck driver who wants $2000, cash, to pull your car out of the muck, just because the next closest tow truck is hours away.

Many economists wouldn’t have a problem with that – in a certain narrow sense, those kinds of price spikes (“gouging”, if you like) may be efficient. But a society in which most sellers feel revulsion toward “taking advantage” is one in which buyers are more willing to engage in transactions. If buyers feel they’re unlikely to get screwed because of their ignorance (as in the the case of AT&T here) or desperate circumstances, then there is more commerce and less effort expended in investigation of deals and precaution against getting caught by local monopolists. In short, transaction costs are lower for everyone.

I’m not advocating legislation here. But the American attitude has it merits. And AT&T is not making itself any friends or building any customer loyalty.

Urban sprawl

February 26th, 2010

I have to credit my lovely wife for this theory, who discovered it by experience with her own employees.

Urban sprawl is caused by wage-and-hour regulation.

Most places have regulations requiring overtime pay (in the US, the usual rule is 1.5x wages past 40 hours/week).

Employers usually can’t afford overtime wages, so most employees can’t earn more by working longer hours. But many employees would rather work and earn more.

So, instead of working more hours, they spend those hours commuting from the suburbs, where housing is cheaper than in the city. Commuting from the suburbs is a way of “working” to get a larger disposable income that isn’t regulated.

I’m willing to bet that the growth of urban sprawl closely tracks the introduction of wage-and-hour regulations.

Regulations are like squeezing a balloon – what goes in where you squeeze comes out somewhere else. When you force people to do what you want, they tend to find other ways to get what they want.